SECURITIES AND EXCHANGE COMMISSION

the Securities

Exchange Act of 1934 (Amendment No. )

☒

☐

¨

¨Statement

☑

¨Statement

¨Materials

American International Group, Inc.

under §240.14a-12

| American International Group, Inc. | ||

☑

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

¨

A Letter from our Chairman & Chief Executive Officer | ||

Peter Zaffino Chairman & Chief Executive Officer | |||||

I am very pleased with the progress AIG made in 2023 and will highlight our significant achievements throughout the year. Our sustained financial performance over the last several years has enabled us to continue to position AIG as a top-performing global insurer. Over the course of the year, we made significant strategic, operational and financial advancements, which created substantial value for AIG’s colleagues, clients, and shareholders, and provided significant momentum as we enter 2024. Our very strong financial results last year were led by excellent underwriting performance, expense discipline as we continued investing for the future, increased investment income, and execution of a balanced capital management strategy. In 2023, we delivered exceptional underwriting profitability that surpassed our 2022 results and delivered a second consecutive year of underwriting income in excess of $2 billion. To put this in context, AIG had significant underwriting losses from 2008-2018, making today’s performance even more impressive. Now, we are well positioned with our breadth and depth of expertise and talent in underwriting, operational capabilities, and claims service to drive AIG’s continued progress. During 2023, we also reached several important milestones by simplifying our business, executing on several divestitures that further re-positioned our portfolio, and significantly reducing volatility. We made remarkable progress towards the separation of Corebridge, completing three secondary offerings that generated approximately $2.9 billion in proceeds. At year end, our ownership stake in Corebridge was approximately 52%, and we expect to continue reducing our ownership of Corebridge in 2024, subject to market conditions. When we are not the majority owner of Corebridge and no longer control its board, we will no longer consolidate our financial results, and this will enable us to be positioned as a leading global property and casualty insurer. Our outstanding performance and strategic positioning in 2023 enabled the execution of our thoughtful and balanced capital management strategy. We increased financial flexibility while reducing debt by $1.4 billion and returning approximately $4 billion to AIG shareholders through $3 billion of common stock repurchases and $1 billion of common stock dividends, including a 12.5% increase in the second quarter of 2023. We finished 2023 with very strong parent liquidity of $7.6 billion, giving us ample capacity to continue executing on our capital management priorities going forward. AIG entered 2024 with strong momentum and we have introduced AIG Next, our future-state business model that will create additional value by weaving a leaner, more unified company together. AIG Next will result in further expense reductions and will support our progress toward achieving our Adjusted Return on Common Equity target of 10% plus, while also creating a less complex company. We are able to deliver multiple high-quality outcomes while moving with pace thanks to the commitment and teamwork of our AIG colleagues around the world. As you will hear from the Board’s Lead Independent Director, John Rice, we enhanced our governance practices in 2023, anchored by active engagement with AIG’s investors and continued refreshment of our Board of Directors. Since our last shareholder meeting in May 2023, the Board welcomed two highly accomplished and eminently qualified Directors, Jimmy Dunne and Chris Inglis. The Board encourages you to read this Proxy Statement and the accompanying Annual Report, and we welcome you to join AIG’s virtual Annual Meeting of Shareholders at www.virtualshareholdermeeting.com/AIG2024, on May 15, 2024, at 11:00 a.m. Eastern Time. AIG is well positioned to help our clients and partners solve a vast array of risk issues while working closely with our stakeholders to navigate an increasingly complex global socioeconomic environment. All of our stakeholders have recognized that we are now setting the standards in the global insurance industry. I thank you for your continued investment of capital and support, and I look forward to continuing to build on the progress we have made as we create the AIG of the future and provide exceptional value to our stakeholders. Sincerely,  Peter Zaffino Chairman & CEO | |||||

A Letter from our Lead Independent Director | ||

John G. Rice Lead Independent Director | Dear Fellow Shareholders: | ||||

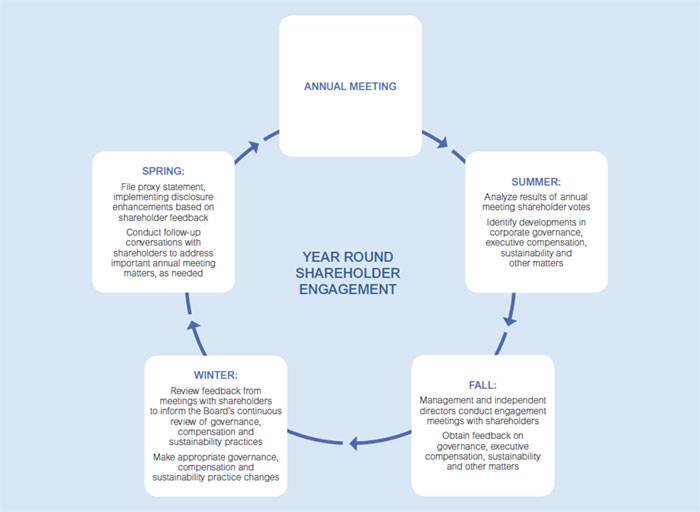

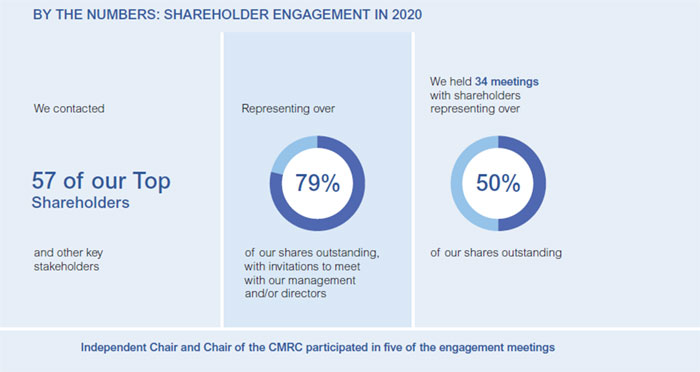

I joined AIG’s Board in 2022 and have been honored to serve as Lead Independent Director since January 1, 2023. AIG management and the Board communicate openly and candidly so that the Board can effectively perform its role. Our meeting agendas are established with the Chairman and CEO and designed to ensure we spend time on the most important matters including both opportunities and challenges. We have executive sessions as part of every meeting, and there is regular director interaction between meetings so questions can be posed, and ideas can be shared. The Board makes an effort to engage consistently and productively with shareholders. This engagement was substantial again this year, with outreach to investors representing 68.9% of shares outstanding and resulting meetings with those representing 54.3% of shares outstanding. Following feedback from investors at these meetings, the We have added two new directors who will be standing for reelection, along with the rest of the Board, at this year’s Annual Meeting. With the addition of Jimmy Dunne and Chris Inglis, the Board stands to benefit from these executives’ business acumen, diverse experience in complex strategic initiatives, and deep commitment to the company. These individuals bring complementary skillsets while also understanding that the Board, as a whole, must be greater than the sum of its parts. Simply stated, our job is As Peter has shared, AIG’s strategic, operational and financial momentum continues, thanks to the Thank you for your continued support of Sincerely,  John G. Rice Lead Independent Director | |||||

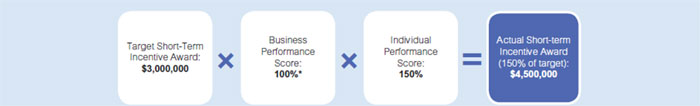

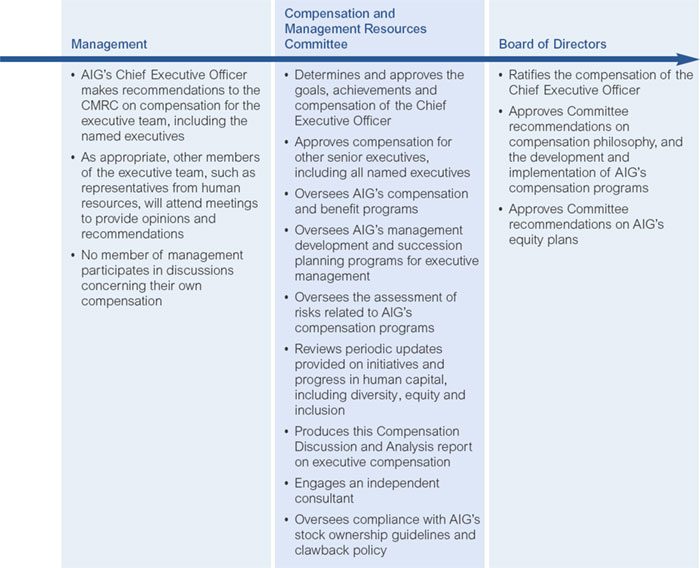

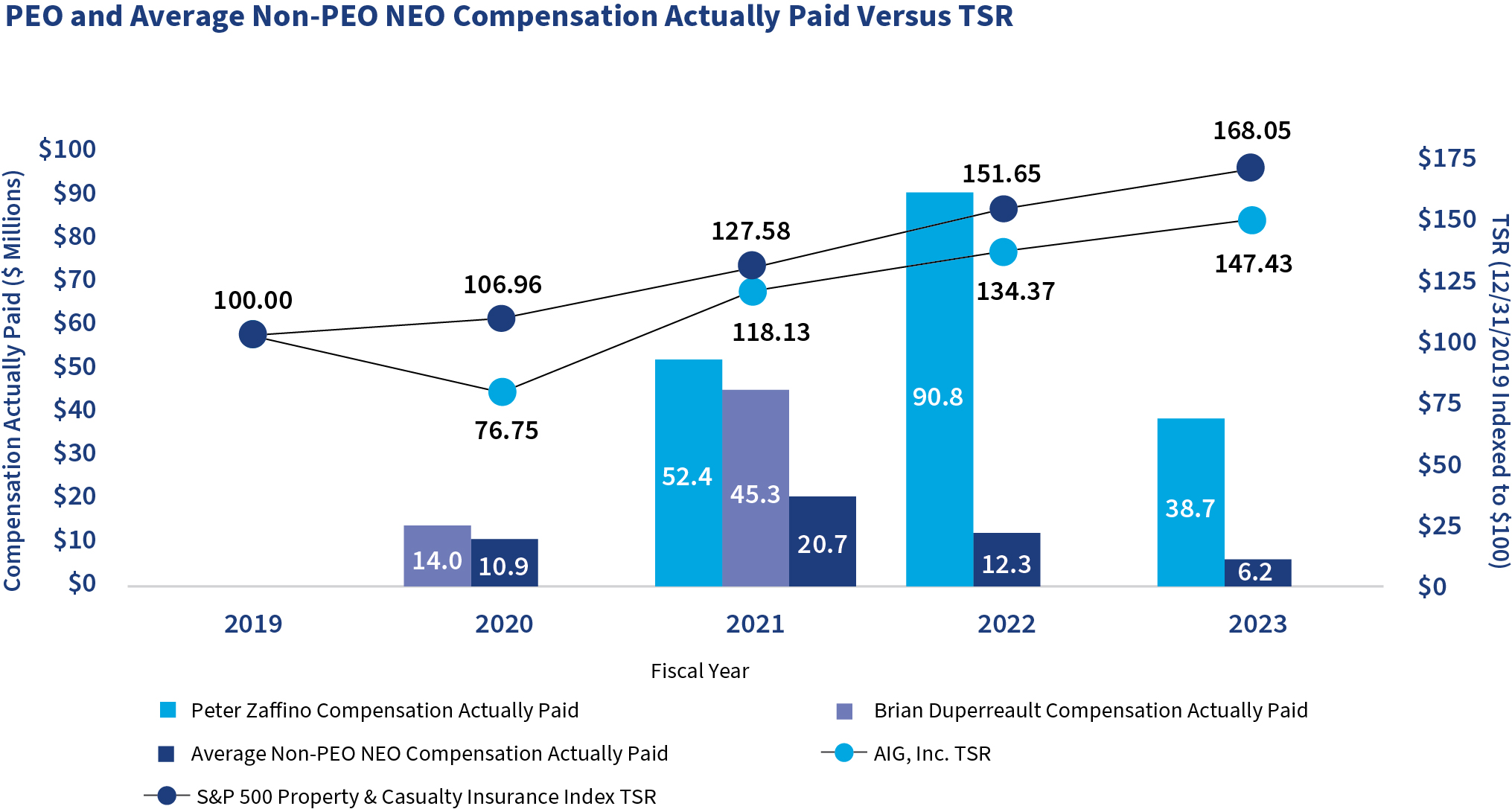

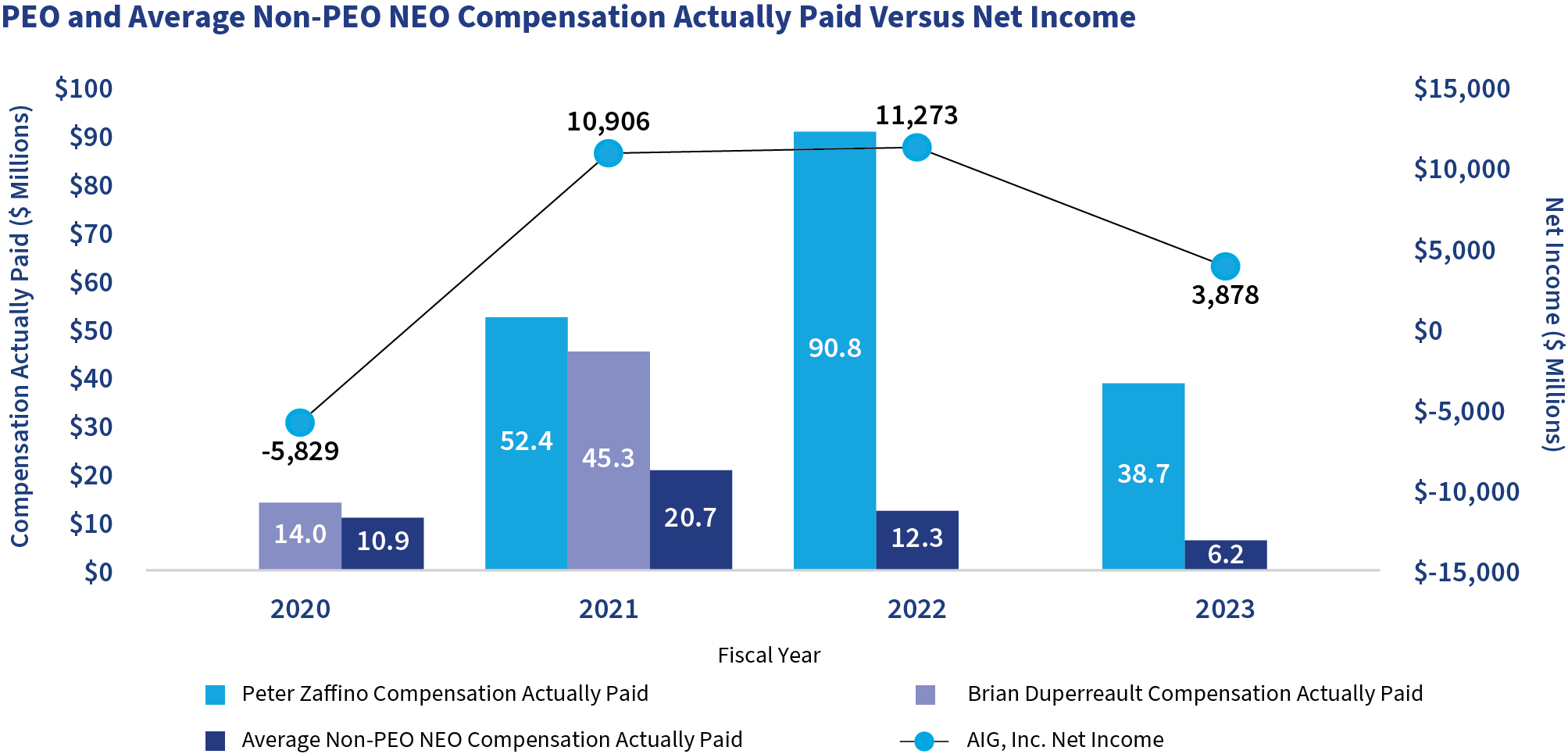

Notice of Annual Meeting of Shareholders | 2024 Annual Meeting of Shareholders to be Held Virtually: This year’s meeting will be held in a virtual format only. Please visit www.virtualshareholdermeeting.com/AIG2024 Date and Time: May 15, 2024 11:00 a.m. Eastern Time | |||||

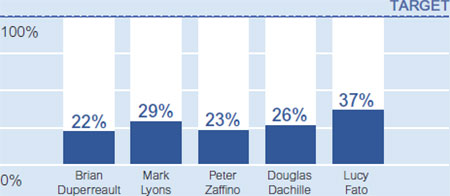

By Order of the AIG Board of Directors. any postponed or reconvened meeting. We This summary highlights information contained in this Proxy Statement. It does not contain all of the information you should consider in making a voting decision, and you should read the entire Proxy Statement carefully before voting. Current Board Lamb Weston Holdings, Inc. We believe our nominees’ diverse and complementary skills, experience and attributes promote a well-functioning, highly qualified Governance (Chair) Qualifications:In light of Mr. Qualifications COMMUNITY INVOLVEMENT In light of COMMUNITY INVOLVEMENT COMMUNITY INVOLVEMENT COMMUNITY INVOLVEMENT LGBTQ+ Corporate Governance Guidelines encourage director education. All new directors participate in The Board fulfills its oversight role with respect to metrics. We believe that we foster a constructive, inclusive and healthy work environment for our employees. Sustainability Matters Additional Information Available in ESG Reports year. not more than five consecutive years. Corporate Governance amount of up to $10,000 per director annually on the same terms and conditions that apply to employees. The following table contains information with respect to the compensation of the individuals who served as independent directors Beneficial Owners Beneficial Owners BRIAN DUPERREAULT Executive Chair For information on Mr. Duperreault’s experience, please see “Proposal 1—Election of Directors.” PETER ZAFFINO President and Chief Executive Officer For information on Mr. Zaffino’s experience, please see “Proposal 1—Election of Directors.” MARK D. LYONS Executive Vice President and Chief Financial Officer Mark D. Lyons joined AIG in June 2018 as Senior Vice President and Chief Actuary and was appointed Executive Vice President and Chief Financial Officer in December 2018. From 2012 until joining AIG, Mr. Lyons served as Executive Vice President, Chief Financial Officer and Treasurer at Arch Capital Group, Ltd., a Bermuda-based global insurance company. Prior to that role, Mr. Lyons had served in various capacities within Arch Insurance U.S. operations, including as Chairman and Chief Executive Officer of Arch Worldwide Insurance Group. Prior to joining Arch Capital Group, Mr. Lyons held various positions at Zurich U.S., Berkshire Hathaway and AIG. DOUGLAS A. DACHILLE Executive Vice President and Chief Investment Officer Douglas A. Dachille joined AIG in September 2015 as Executive Vice President and Chief Investment Officer. Mr. Dachille served as Chief Executive Officer of First Principles Capital Management, LLC (First Principles), an investment management firm, from September 2003 until its acquisition by AIG in September 2015. Prior to co-founding First Principles, he was President and Chief Operating Officer of Zurich Capital Markets. Mr. Dachille began his career at JPMorgan Chase, where he served as Global Head of Proprietary Trading and Co-Treasurer. LUCY FATO Executive Vice President, General Counsel & Global Head of Communications and Government Affairs Lucy Fato joined AIG in October 2017 as Executive Vice President & General Counsel and also served as Interim Head of Human Resources from October 2018 to July 2019. She took on additional responsibilities as Global Head of Communications and Government Affairs in November 2020. From October 2016 until joining AIG, she was Managing Director, Head of the Americas and General Counsel at Nardello & Co. LLC, a global private investigative firm, where she remains on the Advisory Board. Previously, she worked at S&P Global (formerly known as McGraw Hill Financial), a financial information and analytics corporation, where she served as Executive Vice President & General Counsel from August 2014 to October 2015, and as a Consultant from October 2015 to October 2016. Prior to that, Ms. Fato was Vice President, Deputy General Counsel and Corporate Secretary at Marsh & McLennan Companies, Inc. from 2005 to 2014. Ms. Fato began her legal career at Davis Polk & Wardwell LLP where she spent fourteen years, including five as a partner in the Capital Markets Group. SHANE FITZSIMONS Executive Vice President and Chief Administrative Officer Shane Fitzsimons joined AIG as Global Head of Shared Services in July 2019 and currently serves as Executive Vice President and Chief Administrative Officer. He also oversees AIG’s Shared Services, Financial Planning and Analysis and Corporate Real Estate groups. Prior to joining AIG, he was Group Synergy Officer at TATA Group, an Indian multinational conglomerate from April 2018 to June 2019. Previously, Mr. Fitzsimons served in various operational and financial leadership roles at General Electric Company from March 1994 to September 2017. Prior to his time at General Electric Company, Mr. Fitzsimons spent seven years in public accounting in Ireland and the Netherlands. KEVIN T. HOGAN Executive Vice President and Chief Executive Officer, Life and Retirement Kevin Hogan joined AIG as Chief Executive Officer of Global Consumer Insurance in October 2013 and currently serves as Executive Vice President and Chief Executive Officer, Life and Retirement. Prior to joining AIG, Mr. Hogan was Chief Executive Officer, Global Life for Zurich Insurance Group. Prior to Zurich, Mr. Hogan was previously employed by AIG where he began his career and held various positions in Property Casualty and Life and Retirement. KAREN LING Executive Vice President and Chief Human Resources Officer Karen Ling joined AIG as Executive Vice President and Chief Human Resources Officer in July 2019. From July 2014 until joining AIG, she served as Executive Vice President and Chief Human Resources Officer at Allergan plc., a pharmaceutical company. Prior to Allergan, Ms. Ling was Senior Vice President, Human Resources, for Merck & Co., Inc.’s Global Human Health and Consumer Care businesses worldwide. She previously served as Group Vice President, Global Compensation & Benefits at Schering-Plough Corporation prior to its acquisition by Merck & Co., Inc. Prior to joining Schering-Plough Corporation, Ms. Ling held various positions at Wyeth, LLC. DAVID MCELROY Executive Vice President and Chief Executive Officer, General Insurance David McElroy joined AIG in October 2018 as President and Chief Executive Officer of Lexington Insurance Company and was promoted to President and Chief Executive Officer of North America General Insurance in June 2019. He was promoted to Executive Vice President and Chief Executive Officer, General Insurance in August 2020. Prior to joining AIG, Mr. McElroy served as Executive Chairman of Arch Insurance Group Inc. from January 2018 to July 2018 and as Vice Chairman of Arch Worldwide Insurance Group from October 2017 to December 2017. He previously served as Chairman and Chief Executive Officer of Arch Worldwide Insurance Group from September 2012 to September 2017. Arch Insurance Group, Inc. and Arch Worldwide Insurance Group are divisions of Arch Capital Group, Ltd., a Bermuda based global insurance company. Prior to joining Arch Capital Group, Mr. McElroy served in various leadership roles at The Hartford Financial Services Group, Inc., Reliance National Insurance Company and The Chubb Corporation. NAOHIRO MOURI Executive Vice President and Chief Auditor Naohiro Mouri joined AIG in July 2015 as Senior Managing Director of Asia Pacific Internal Audit and was appointed Executive Vice President and Chief Auditor in March 2018. From November 2013 to July 2015, he was a Statutory Executive Officer, Senior Vice President and Chief Auditor for MetLife Japan and, from July 2007 to November 2013, he was Chief Auditor at JP Morgan Chase for Asia Pacific. He has also held chief auditor positions at Shinsei Bank, Morgan Stanley Japan and Deutsche Bank Japan. JOHN P. REPKO Executive Vice President and Chief Information Officer John P. Repko joined AIG in September 2018 as Executive Vice President and Chief Information Officer. Additionally, he leads Global Sourcing. Prior to joining AIG, he was Vice President and Global Chief Information Officer of Johnson Controls International plc, a technology and industrial company, taking up this position with the merger of Johnson Controls, Inc. and Tyco International plc. Previously, he worked at Tyco International plc as Senior Vice President, Chief Information Officer and Enterprise Transformation Leader from 2012 to 2016. Prior to joining Tyco International plc, Mr. Repko held various chief information officer roles at Covance Inc., SES Global and General Electric’s GE Americom division. The Board and the CMRC reflecting consistently strong financial results in General Insurance, Corebridge and AIG Corporate Individual Performance Scorecards policies (as applicable) In making the Cumulative TSR delivered during the three-year performance period 2023 Compensation Decisions and Outcomes Analysis Analysis Termination Practices and Policies In addition, we have entered into an employment agreement with the Chairman & CEO which provides for severance payments and benefits payable to him upon a qualifying termination of employment. Mr. Zaffino is not a participant in the ESP. Mr. Zaffino under his employment agreement. Compensation Risk Review 2024 Compensation Program Design and Decisions that is fully compliant with SEC and NYSE requirements and resolved that it remained appropriate to also maintain the existing Clawback Policy, which affords protections beyond those required by the SEC, with minor amendments as indicated in the table below. annual risk review process. 1986. Table Estimated Future Payouts 2023. Stock options granted in 2023 have an exercise price equal to the closing price of the underlying shares of AIG Parent common stock on the NYSE on the date of grant. her Transition Agreement. are included in the 2023, 2022 and 2021 PSU amounts shown above. 2024. above. AIG five percent reduction. executives other than Mr. Zaffino and Mr. Hogan. The terms of the ESP are consistent with our compensation design philosophy as described in “Compensation Discussion and Analysis — Compensation Design.” Plan provisions with respect to termination without cause (except that her outstanding stock options will remain exercisable for their full scheduled term). Outstanding stock options will vest and remain exercisable for three years after death. In no event will any The following table sets forth the compensation and benefits that would have been provided to each of the current named executives if he or she had been terminated on December 31, For the former executives listed in the table, the amounts show those that were actually payable in connection with the executive's employment termination or transition to non-executive officer during 2023. equity-based awards as of December 31, 2023, based on the closing sale price on the NYSE of $21.66 on December 29, 2023. In addition, the amounts in this column include, for all of the named executives, the outstanding 2023 PSU and RSU award amounts include the value of accrued dividend equivalent rights on such awards, which are paid in cash if and when such related shares of AIG Parent common stock are delivered. 278. that our audited financial statements are fairly presented in accordance with U.S. generally accepted accounting principles. The Audit partners are subject to rotation requirements that limit the number of consecutive years an individual partner may provide service to AIG. For lead and concurring audit partners, the limit is five years. The Audit Committee is present the proposal and supporting statement set forth below for consideration at the 2024 Annual Meeting. AIG is not responsible for the accuracy or content of the proposal and supporting statement. what goes on. The Exchange Commission. Meeting? In addition, if you have returned a signed proxy card or submitted voting instructions by telephone or the internet, the proxy holders will have, and intend to exercise, discretion to vote your shares in accordance with their best judgment on any matters not identified in this Proxy Statement that are brought to a vote at the Annual Meeting. Uncontested Election Receives More Votes “Against” than “For”? Will Any Other 1-877-244-2110, menu item #3 (to access the AIG this Proxy Statement. Certain of the operating performance measurements used by 2021 (AIG Parent) common stock at the close of business on March 18, 2024 (the record date), you are entitled to receive this Notice of the 2024 Annual Meeting and to vote at the 2024 Annual Meeting, either during the virtual meeting or by proxy.

TABLE OF CONTENTS100 for instructions on how to attend and vote online

March 30, 2021Dear Fellow AIG Shareholder,AIG’s

Executive Leadership Team and global workforce are maintaining significant momentum and a continued sense of urgency on(the Board) is soliciting proxies to be voted at our path to becoming a top performing company.AIG is effectively managing through COVID-19 and its collateral effects on the global economy because of the strong foundation we have been building since late 2017. The company is well positioned for long-term, sustainable, and profitable growth.AIG has instilled a culture of underwriting excellence, adjusted risk tolerances, implemented best-in-class reinsurance programs, strengthened its vast global footprint, de-risked the balance sheet and maintained a diversified investment portfolio.Our announced intention to separate the Life and Retirement business from AIG, which we believe will enable each entity to achieve a more appropriate and sustainable valuation, was made possible by the team’s tremendous progress strengthening General Insurance in particular and positioning each of our businesses as a market leader.Despite the challenges presented by COVID-19, the company accelerated the execution of AIG 200, our enterprise-wide transformation designed to position AIG for the future.Over the last year, we prioritized the well-being of AIG colleagues, who showed resilience and attentiveness in service of all stakeholders despite unprecedented disruptions. We also enhanced our efforts to promote value creation in our communities and continue to make progress with respect to diversity, equity, and inclusion across AIG.On March 1, 2021, we seamlessly transitioned into our new roles as Executive Chair and Lead Independent Director, respectively, and know that the company is in great hands with Peter Zaffino as President and Chief Executive Officer of AIG.The Board would like to thank Henry Miller, who is retiring as a Director, for his service and valuable contributions since 2010. In addition, we were pleased to welcome James Cole, Jr. to the Board on March 15, 2021.We invite you to attend the virtual 20212024 Annual Meeting of Shareholders on Wednesday, May 12, 2021,15, 2024, and at 11:00 a.m. Eastern Daylight Time.also encourage youexpect that the proxy materials and notice of internet availability will be mailed and made available to read this Proxy Statement and the Annual Report, and to vote as we recommendshareholders beginning on the enclosed proposals in advance of the meeting. Please vote in advance of the meeting even if you plan to participate virtually. Every vote matters.Thank you for your investment in AIG. We remain focused on delivering value for you as we strive to become a leading insurance franchise.Sincerely,

Table of Contents

Brian DuperreaultDouglas M. SteenlandExecutive ChairA Letter from our Lead Independent Director March 30, 2021AMERICAN INTERNATIONAL GROUP, INC. (AIG)175 Water Street, New York, N.Y. 10038Time and Date*11:00 a.m., Eastern Daylight Time, on Wednesday, May 12, 2021.Access*Meeting live via the Internet—please visit www.virtualshareholdermeeting.com/AIG2021.Mailing DateThis Proxy Statement, 2020 Annual Report and proxy card or voting instructions were either made available to you over the Internet or mailed to you on or about March 30, 2021.Items of Business1. To elect the thirteen nominees recommended by our Board of Directors as directors of AIG to hold office until the next annual election and until their successors are duly elected and qualified2. To vote, on a non-binding advisory basis, to approve executive compensation3. To vote on a proposal to approve the American International Group, Inc. 2021 Omnibus Incentive Plan4. To act upon a proposal to ratify the selection of PricewaterhouseCoopers LLP as AIG’s independent registered public accounting firm for 20215. To vote on a shareholder proposal to give shareholders who hold at least 10 percent of AIG’s outstanding common stock the right to call special meetings6. To transact any other business that may properly come before the meetingRecord DateYou can vote if you were a shareholder of record at the close of business on March 17, 2021.AdmissionTo participate in the Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials or on your proxy card.AdditionalAdditional information regarding the matters to be acted on during the Annual Meeting is included in this Proxy Statement.Proxy VotingYou can vote your shares before the Annual Meeting over the Internet or by telephone. If you received a paper proxy card by mail, you may also vote by signing, dating and returning the proxy card in the envelope provided. You may also vote your shares during the Annual Meeting by logging into the virtual meeting site using the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card, or voting instruction form.* In light of COVID-19, for the safety and well-being of our shareholders and employees, and taking into account the protocols of local, state and federal governments, we have determined that the 2021 Annual Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. We believe that the virtual meeting format affords our shareholders an opportunity for meaningful participation, and we have taken steps to ensure that shareholders will be able to attend, vote and submit questions from any location via the Internet. For more details regarding how to participate in the virtual meeting, please see “Voting Instructions and Information.”By order of the Board of Directors,

ROSE MARIE E. GLAZERCorporate Secretaryvia the Internet on May 12, 2021. This15, 2024. The Notice of the 2024 Annual Meeting of Shareholders and Proxy Statement, the 2020as well as our 2023 Annual Report, are available free of charge at www.proxyvote.com or at www.aig.com. References in either document to our website are for the convenience of readers, and information available at or through our website is not a part of, nor is it incorporated by reference in, the Proxy Statement or Annual Report.other materials are available inProxy Statement, we use the Investors section of AIG’s corporate website at www.aig.com.Executive Summary These proxy materials are first being sent to shareholders of American International Group, Inc., a Delaware corporation (AIG), commencing on or about March 30, 2021.VOTING MATTERS AND VOTE RECOMMENDATIONMatterVoting Matters and Vote Recommendation Board VoteRecommendationFor Information, see:Item 1 Election of the Ten Director Nominees Named in this Proxy Statement FOR each Director Nominee 1.Item 2Election of thirteen directorsAdvisory Vote to Approve Named Executive Officer CompensationFOR EACH DIRECTORNOMINEE13382.Item 3Advisory vote on executive compensationFORPage 1143.Approval of American International Group, Inc. 2021 Omnibus Incentive Plan (the 2021 Plan)FORPage 1164.RatificationRatify Appointment of PricewaterhouseCoopers LLP to Serve as AIG’s independent registered public accounting firmIndependent Auditor for 20212024FOR 12892Shareholder ProposalProposalsItem 4 Proposal Requesting an Independent Board Chair Policy AGAINST 5.Item 5Proposal Requesting a Director Election Resignation By-Law AGAINST give shareholders who hold at least 10 percentCorporate Governance Guidelines – Completed a comprehensive review and update of our outstanding common stockCorporate Governance Guidelines, including broadening the rightLead Independent Director duties (see page 24)call special meetingsBoard committee charters – Completed a thorough review of each Board committee charter, which included benchmarking charters against certain companies in the Fortune 100 (see page 29) AGAINST35) Page 13127)

AIG believes that the virtual meeting format affords our shareholders an opportunity for meaningful participation, including the ability to vote and ask questions electronically during the meeting. For detailed information on the voting process and how to attend the AIG Annual Meeting of Shareholders to be held virtually via the Internet on May 12, 2021 (Annual Meeting), or any adjournment or postponement thereof, please see “Voting Instructions and Information” beginning on page 136.2021 Proxy Statement

1Executive SummaryABOUT AIGAIG isa wide range of property casualty insurance life insurance, retirement solutions that help businesses and other financial services to customersindividuals in approximately 80190 countries and jurisdictions.

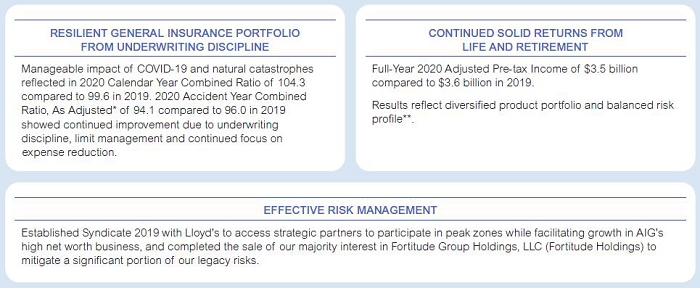

In 2020, AIG effectively managedjurisdictions protect their assets and manage risks through COVID-19our operations and its collateral effects on the global economy thanks to the strong foundation created since late 2017 to instill a culture of underwriting excellence, adjust risk tolerances, implement a best-in-class reinsurance program, de-risk our balance sheet and maintain a balanced investment portfolio. We continue this momentum and embark on an important phase of our journey to becoming a top performing company with our proactive leadership transition and planned corporate structure changes.

2

2021 Proxy StatementExecutive Summary

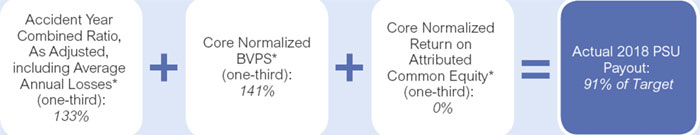

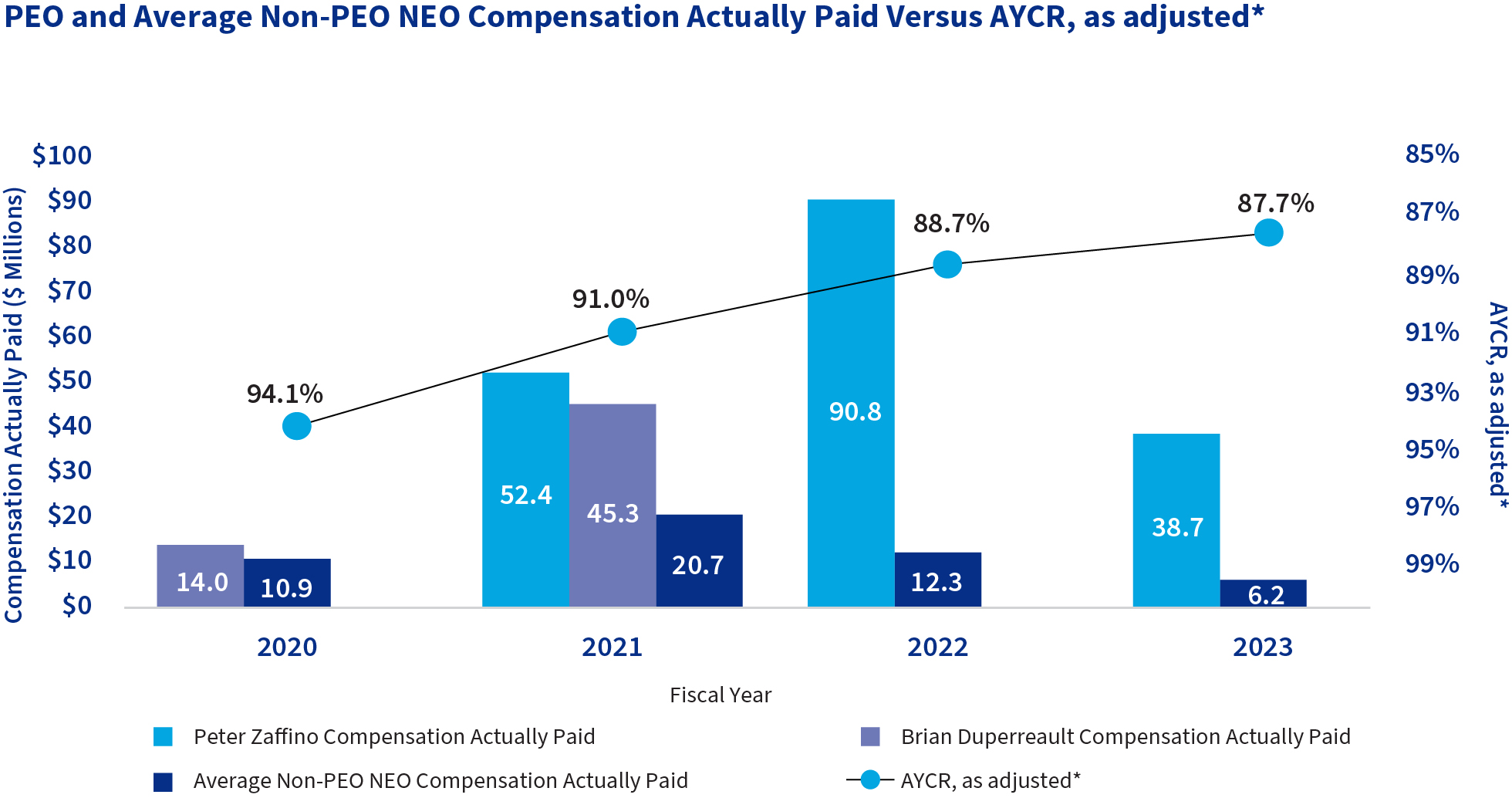

*Accident Year Combined Ratio, As Adjusted is a non-GAAP financial measure. AIG’s 2020, 20192018 Calendar Year Combined ratio was 104.3%, 99.6%Financial Flexibilityas demonstrated by approximately $45 billion in shareholders’ equity and 111.4%, respectively. See Appendix A for a reconciliation showing how this metric is calculated from our consolidated financial statements.AIG Parent liquidity sources of $12.1 billion as of December 31, 2023.**On October 26, 2020, AIG announced its intention to separate its LifeRetirement business from AIG. See “—AnnouncementShareholder ReturnPlanned Lifeour common stock and Retirement Separation.”paid $1.0 billion of common and preferred stock dividends***RBC is a formula designed to measure the adequacyan insurer’s statutory surplus90.6 compared to 91.9 in 2022, and sub-100 in every quarter of 2023risks inherent tosale of Laya Healthcare Limited for €691 million ($731 million) and announced the business. The inclusionsale of RBC measures is not intendedAIG Life Limited for the purposeconsideration of ranking any insurance company or for use in connection with any marketing, advertising or promotional activities.

£460 million2021 Proxy Statement

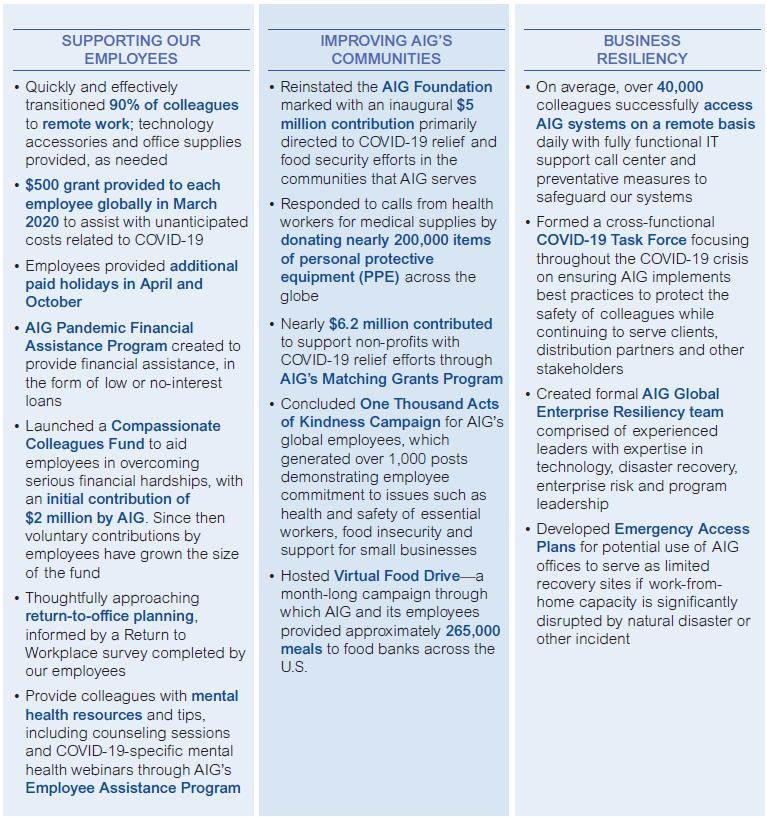

3Executive SummaryAIG’S RESPONSE TO COVID-19AIG acted quickly in early 2020 to respond to the COVID-19 crisis, with a focus on supporting our colleagues and communities and on business resiliency.

4

2021 Proxy StatementExecutive SummaryANNOUNCEMENT OF PLANNED LIFE AND RETIREMENT SEPARATION•Planned initial disposition of up to 19.9% interest•Seek to unlock value for shareholders and other stakeholders•Made possible due to strengthening of General Insurance business since 2017In October 2020, AIG announced its intention to separate its Life and Retirement businessAIG. This decision followed a comprehensive review by the Board of Directors (Board) and management of AIG’s composite structure and was made possible by significant work done since 2017 to strengthen the fundamentals of AIG’s General Insurance business. Any separation transaction, which is currently contemplated to include an initial disposition of up to a 19.9 percent interest in our Life and Retirement business, will be subject to the satisfaction of various conditions and approvals, including approval by the Board, receipt of insurance and other required regulatory approvals, and satisfaction of any applicable requirements of the U.S. Securities and Exchange Commission (SEC). The Board intends to accomplish the separation in a way that unlocks value for our shareholders and other stakeholders and establishes two strong, market-leading companies.No assurance can be given regarding the structure of the initial disposition of up to a 19.9 percent interest in the Life and Retirement business or the specific terms or timing thereof, or that a separation will in fact occur.EXECUTION OF THOUGHTFUL, WELL-COORDINATED SUCCESSION PLANOn October 26, 2020, audited financial statements. announced that Peter Zaffino would become President and Chief 2024 PROXY STATEMENT7Officer, Brian Duperreault would become Compensation HighlightsChair and Douglas Steenland would become Lead Independent Director, in each case effective March 1, 2021. Mr. Zaffino also joined the Board on October 26, 2020. This transition reflects the execution of a thoughtful, well-coordinated Chief Executive Officer succession plan overseen by the Board with support from theCompensation Highlightsconsultation with the Chairform of Performance Share Units (PSUs) and stock optionsNominating and Corporate Governance Committee (NCGC). The Board determined that Mr. Zaffino was the right choice to become AIG’s next Chief Executive Officer on the basis of the success he demonstrated as AIG’s President and Global Chief Operating Officer and his leadership over the turnaround of AIG’s General Insurance business as its Chief Executive Officer. Mr. Duperreault’s extensive experience and established relationships with AIG’s directors and stakeholders enable him to lead the Board in overseeing the company through the transition of a new Chief Executive Officer and major transformative transactions, including the separation of AIG’s Life and Retirement business. Mr. Duperreault’s term as Executive Chair will end on December 31, 2021, at which time he will become a non-officer employee of AIG for one year, providing assistance and advice to the extent requested by the Chief Executive Officer. Mr. Steenland leverages his extensive business experience and leadership to ensure continued robust, independent oversight of management by the independent directors.2021 Proxy Statement

5Executive Summary2021 PRIORITIES

6

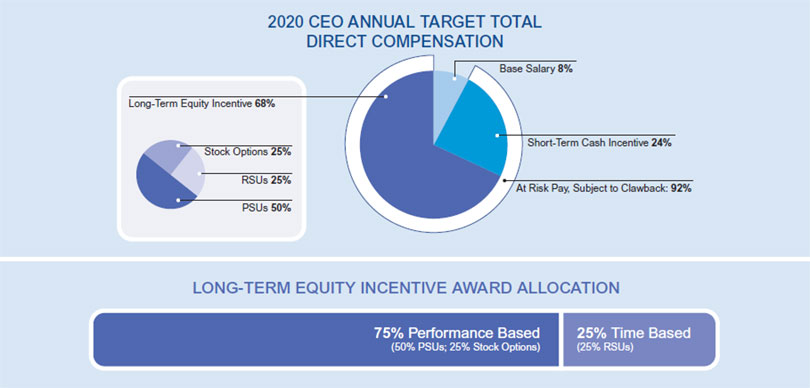

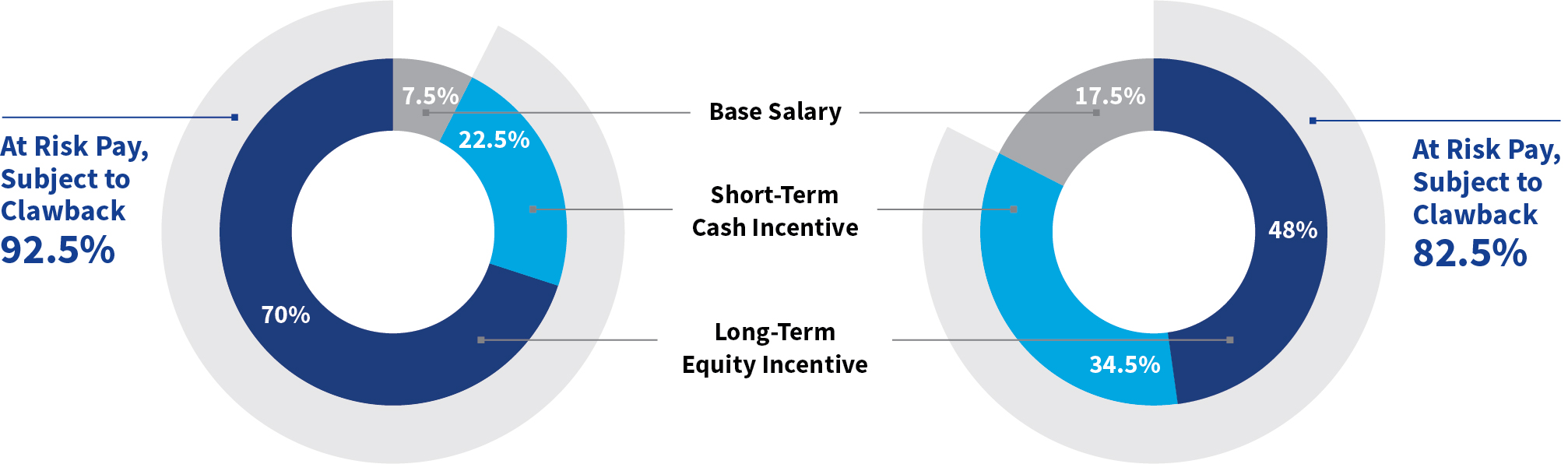

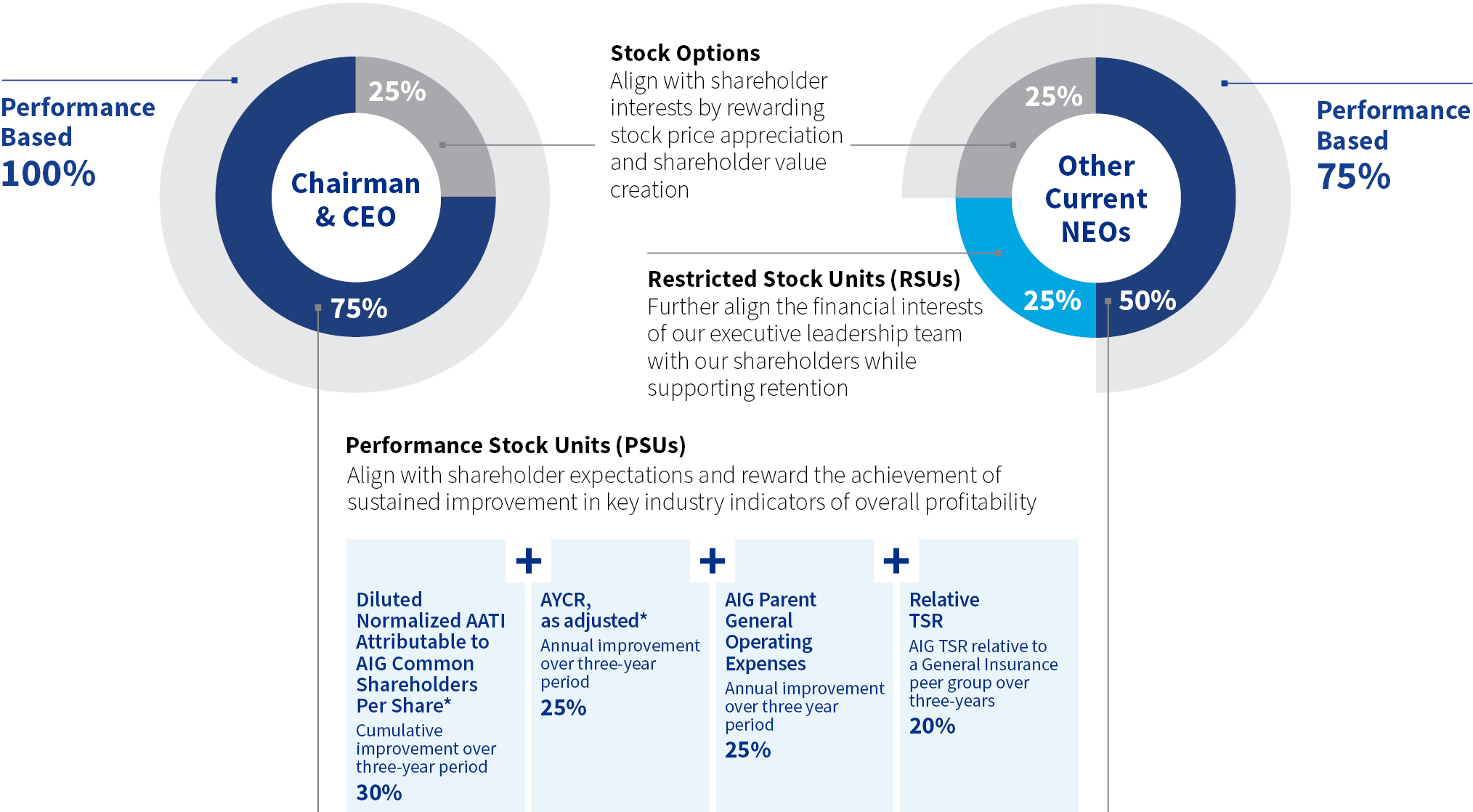

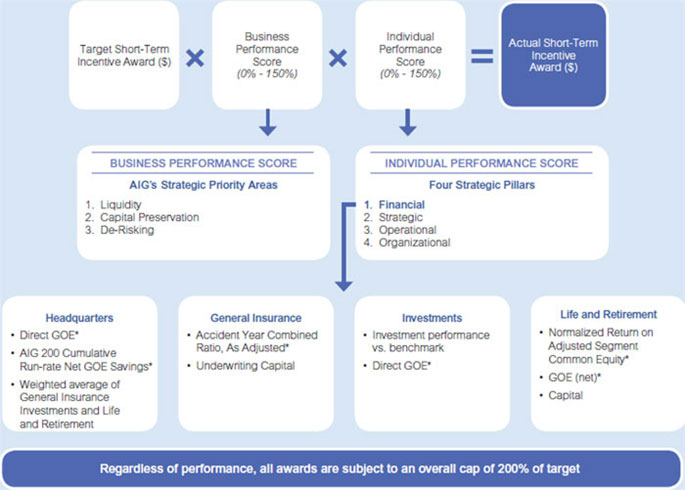

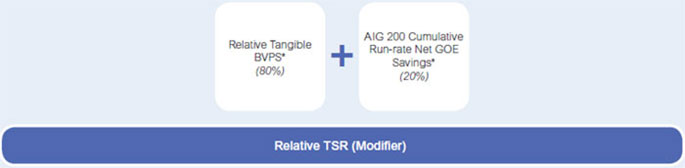

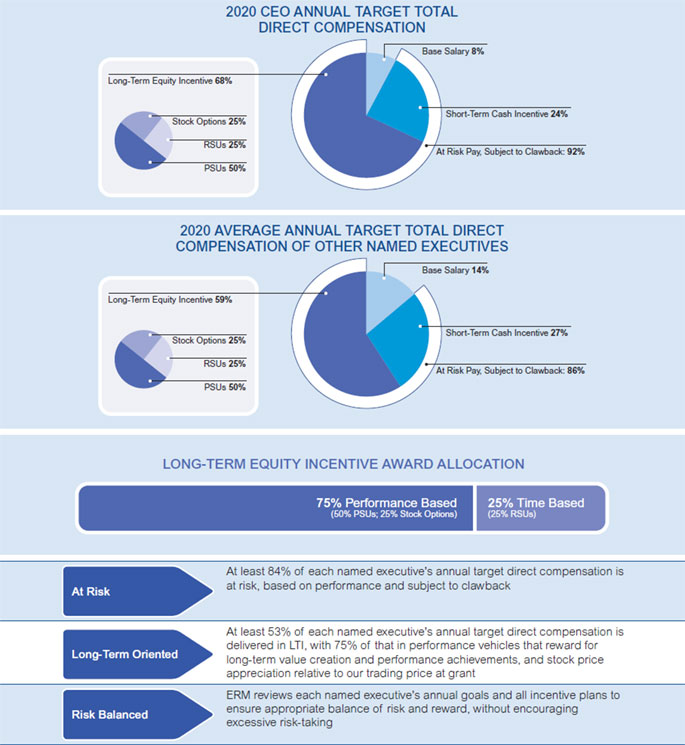

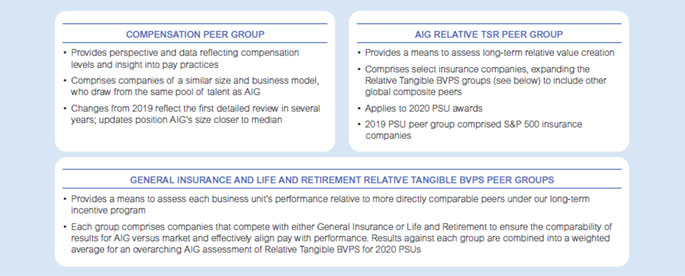

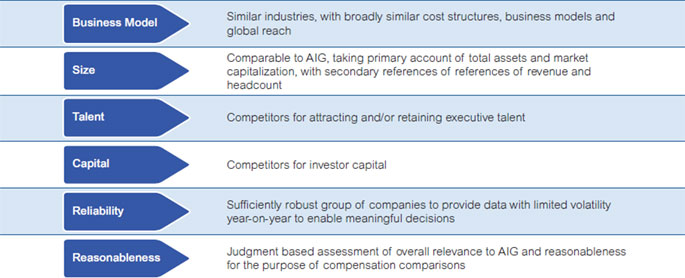

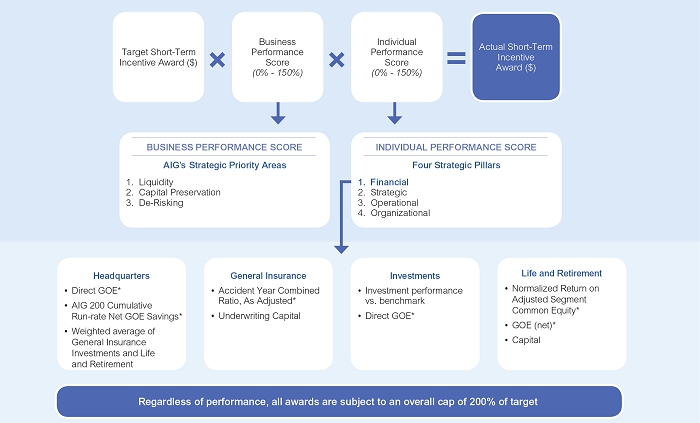

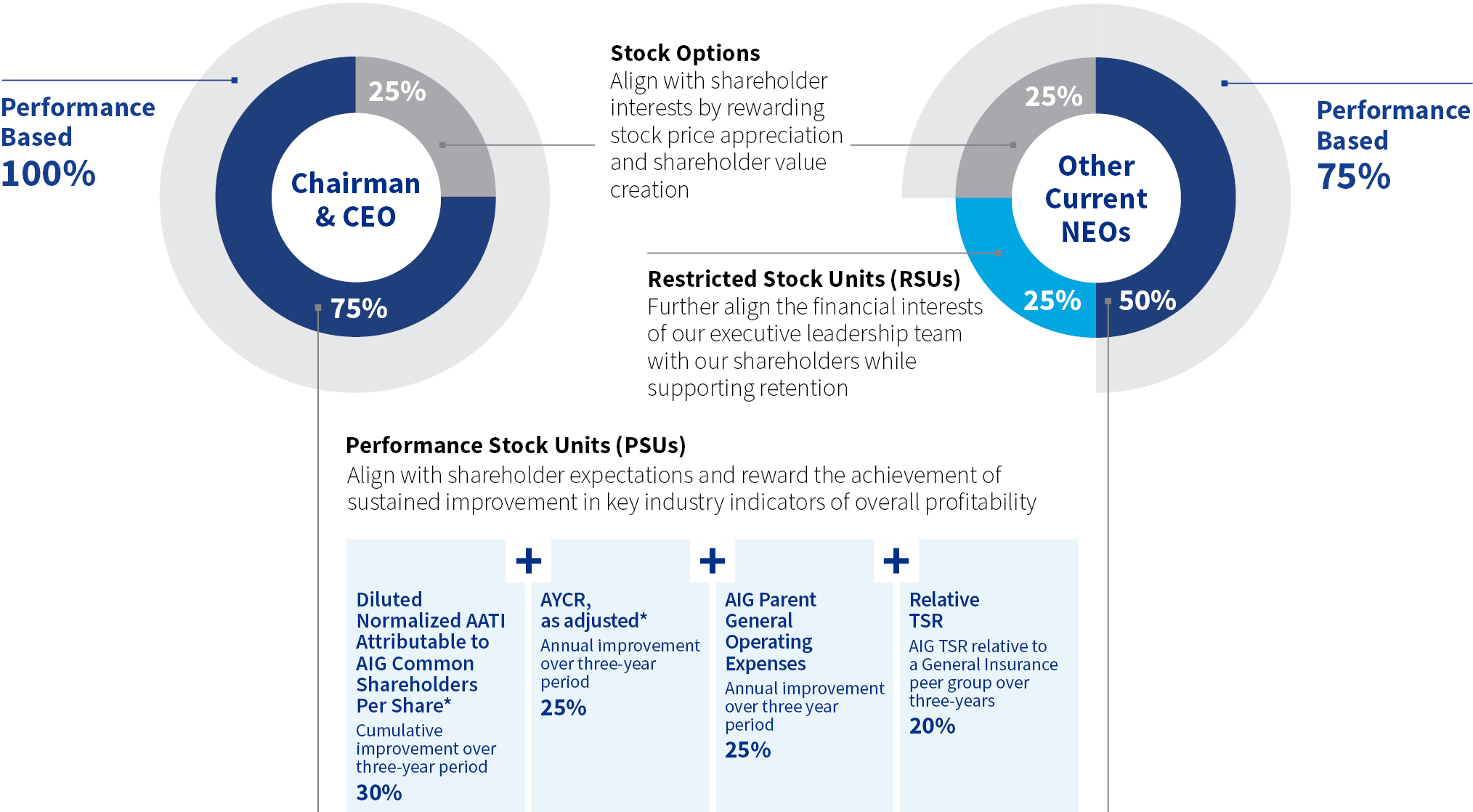

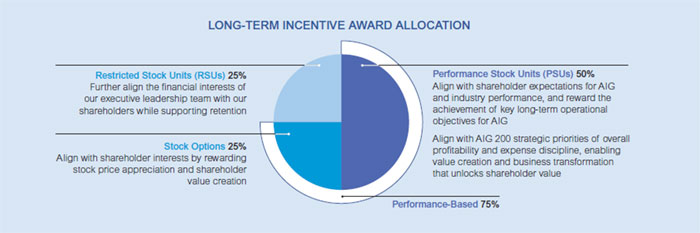

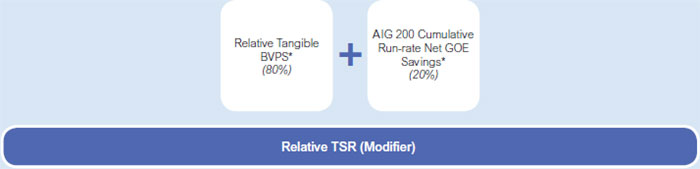

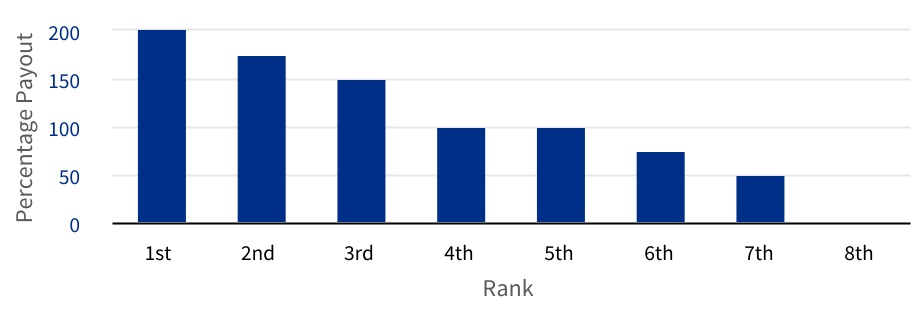

2021 Proxy StatementExecutive SummaryCOMPENSATION HIGHLIGHTSThe onset of the COVID-19 crisis and its collateral effects on the global economy in the first quarter of 2020 required the CMRC to pivot and adapt its approach to executive compensation to address AIG’s changing priorities, while continuing to reinforce the importance of transformation initiatives.Important aspects of our 2020 executive compensation framework remained consistent with the framework for 2019:•Short-term incentive (STI) awards continued to be based on a combination of Business and Individual Performance Scores combined on a multiplicative basis, meaning if either element is zero, no STI award is earned;•The Individual Performance Score component of STI awards continued to assess performance under four pillars—Financial, Strategic, Operational and Organizational—which reflect various important initiatives for AIG including employee engagement, well-being, and diversity, equity and inclusion;•Long-term incentive (LTI) awards continued to be granted in a combination of performance share units (PSUs) (50%), stock options (25%) and restricted stock units (RSUs) (25%);•2020 PSUs continued to be subject to performance measures combining financial, operational and total shareholder return (TSR) metrics; and•Performance requirements for the 2018 and 2019 PSUs granted to our named executives, remained unchanged and the CMRC did not use discretion when adjudicating the performance of the 2018 PSU awards for our named executives.However, other aspects of our 2020 program and some of the underlying details changed to align with our priority focus areas within the context of an uncertain operating environment as a result of the COVID-19 crisis:•The Business Performance Score component of the 2020 STI plan was assessed on a company-wide basis rather than on a business unit basis, reflecting our enterprise-wide focus on liquidity, capital preservation and de-risking;•Business unit accountability was maintained, but through the Financial pillar of our Individual Performance Score assessment in the STI plan in 2020;•Overall business performance and business unit performance were assessed using a disciplined discretion framework that assessed quantifiable results against internal expectations with respect to AIG’s capital and liquidity position and risk profile in the context of the COVID-19 crisis; and•The 2020 PSUs granted as part of our LTI awards were subject to new performance metrics: Relative Tangible Book Value Per Common Share (BVPS)* growth, AIG 200 Cumulative Run-rate Net General Operating Expense (GOE) Savings* and TSR. Both BVPS and TSR will be measured on a relative basis, mitigating the need to calibrate long-term goals that might ultimately be too challenging or too easy to attain. The AIG 200 Cumulative Run-rate Net GOE Savings* goals were unchanged from those developed as part of AIG 200 when it was announced in 2019.*We make adjustments to U.S. GAAP financial measures for purposes of this performance metric to ensure that results properly reflect management contributions. See Appendix A for an explanation of how this metric is calculated from our audited financial statements.2021 Proxy Statement

7Executive Summary2020 CHIEF EXECUTIVE OFFICER COMPENSATIONThe 2020 annual target total direct compensation opportunity and pay mix for Mr. Duperreault, our Chief Executive Officer during 2020, is set forth below. Annual

Base Salary Target

Short-Term

Incentive Target

Long-Term

Incentive Target

Total Direct

CompensationBrian Duperreault $1,600,000 $4,500,000 $12,900,000 $19,000,000 Chief Executive Officer* * Mr. Duperreault became Executive Chair, effective March 1, 2021.

AIG’s 2020 compensation programs and the Board and CMRC’s 2020 compensation decisions, which are outlined in detail indetailed under “Executive Compensation—Compensation“Compensation Discussion and Analysis” beginning on page 5239, balanced rewarding our named executives for their extraordinary leadership through the unprecedented COVID-19 crisis with taking into account the experience.our shareholders in a year of significant global market volatility. This was demonstrated in particular in the STI decisions made with respect to Mr. Duperreault, our Chief Executive Officer in 2020. In light of AIG’s TSR relative to compensation peers in 2020, the CMRC and Mr. Duperreault determined that the Chief Executive Officer’s 2020 STI award should be paid at target, notwithstanding AIG’s successful navigation of the unprecedented COVID-19 crisis and Mr. Duperreault’s efforts in executing a well-coordinated Chief Executive Officer succession process.The Board and CMRC remain committed to executive compensation programs that attract, motivate, reward and incentivize highly qualified leaders as AIG continues its transformation to become a leading insurance franchise and a top performing company.8

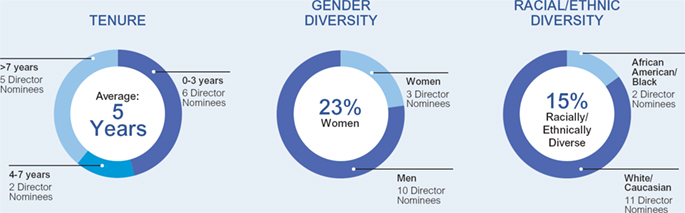

2021 Proxy StatementExecutive SummaryCORPORATE GOVERNANCE HIGHLIGHTSBALANCED AND INDEPENDENT BOARD OF DIRECTORSAIG strivesWe strive to maintain a balanced and independent Board that is committed to representing the long-termlong-term interests of AIG’s shareholders and hasour shareholders. We seek to have a Board that possesses the substantial and diverse skills, experience and attributes necessary to provide strategic oversight of AIG’s journey.guidance on our strategy and oversee management’s approach to addressing the challenges and risks facing the Company. The following table provides summary information about each of our thirteenten director nominees. We are askingThe Board recommends that our shareholders to elect all thirteenten director nominees listed below during the Annual Meeting, to hold office until the next annual election and until their successors are duly elected and qualified or their earlier resignation.Meeting. Each nominee is elected annually by a majority of votes cast.Name Age Director

SinceOccupation/Background Independent Other Public Boards

Committee

Memberships(1)James Cole, Jr. 52 2021 Chairman and Chief Executive Officer of The Jasco Group, LLC; Former Delegated Deputy Secretary of Education and General Counsel of the U.S. Department of Education ✓ (2) W. Don Cornwell 73 2011 Former Chairman of the Board and Chief Executive Officer of Granite Broadcasting Corporation ✓ Natura &Co Holding S.A.; Viatris Inc.

(Chair)

Brian Duperreault 73 2017 Executive Chair of AIG John H. Fitzpatrick 64 2011 Former Secretary General of The Geneva Association; Former Chief Financial Officer, Head of the Life and Health Reinsurance Business Group and Head of Financial Services of Swiss Re ✓

William G. Jurgensen 69 2013 Former Chief Executive Officer of Nationwide Insurance ✓

(Chair)

Christopher S. Lynch 63 2009 Former National Partner in Charge of Financial Services of KPMG LLP ✓ Tenet Healthcare Corporation

(Chair)

Linda A. Mills 71 2015 Former Corporate Vice President of Operations of Northrop Grumman Corporation ✓ Navient Corporation

(Chair)

Thomas F. Motamed 72 2019 Former Chairman and Chief Executive Officer of CNA Financial Corporation ✓ Kairos Acquisition Corp

Peter R. Porrino 64 2019 Former Executive Vice President and Chief Financial Officer of XL Group Ltd ✓

(Chair)

Amy L. Schioldager 58 2019 Former Senior Managing Director and Global Head of Beta Strategies at BlackRock, Inc. ✓

Douglas M. Steenland,

Lead Independent Director69 2009 Former President and Chief Executive Officer of Northwest Airlines Corporation ✓ American Airlines Group Inc.; Hilton Worldwide Holdings Inc. (3) Therese M. Vaughan 64 2019 Former Chief Executive Officer of the National Association of Insurance Commissioners; Executive in Residence and Former Visiting Distinguished Professor and Dean of the College of Business and Public Administration at Drake University ✓ Verisk Analytics, Inc.; West Bancorporation, Inc.

Peter S. Zaffino 54 2020 President and Chief Executive Officer of AIG Committeesthe nominee’s failure to receive the required vote and (2) the Board's acceptance of the resignation. The Board (Board Committees)

Audit Committee

Risk and Capital Committee

Compensation and Management Resources Committee

Technology Committee

Nominating and Corporate Governance Committee(2) Mr. Cole has been appointed to serve as a memberwill accept that resignation unless the NCGC recommends, and the Board determines, that the best interests of the AuditCompany and Technology Committees, effectiveits shareholders would not be served by doing so.Director

SinceDirector Nominee Age Occupation and Background Audit CMR NCG Risk

Paola Bergamaschi 62 2022 Former Global Banking and Capital Markets Executive at State Street Corporation, Credit Suisse and Goldman Sachs

James Cole, Jr. 55 2021 Chairman & Chief Executive Officer of The Jasco Group, LLC; Former Delegated Deputy Secretary of Education and General Counsel of the U.S. Department of Education C

James (Jimmy) Dunne III 67 2023 Vice Chairman and Senior Managing Principal, Piper Sandler

John (Chris) Inglis 69 2024 Strategic Advisor at Paladin Capital Group; Former National Cyber Director

Linda A. Mills 74 2015 Former Corporate Vice President of Operations, Northrop Grumman Corporation C

Diana M. Murphy 67 2023 Managing Director, Rocksolid Holdings LLC

Peter R. Porrino 67 2019 Former Executive Vice President & Chief Financial Officer, XL Group Ltd C C

Lead Independent Director67 2022 Former Non-Executive Chairman, GE Gas Power; Former President & Chief Executive Officer, GE Global Growth Organization

Vanessa A. Wittman 56 2023 Former Chief Financial Officer, Glossier, Inc.

Peter Zaffino 57 2020 Chairman & Chief Executive Officer, AIG 31, 2021.(3) Mr. Steenland, as Lead Independent Director, is an ex-officio, non-voting member of all Board Committees.2021 Proxy Statement

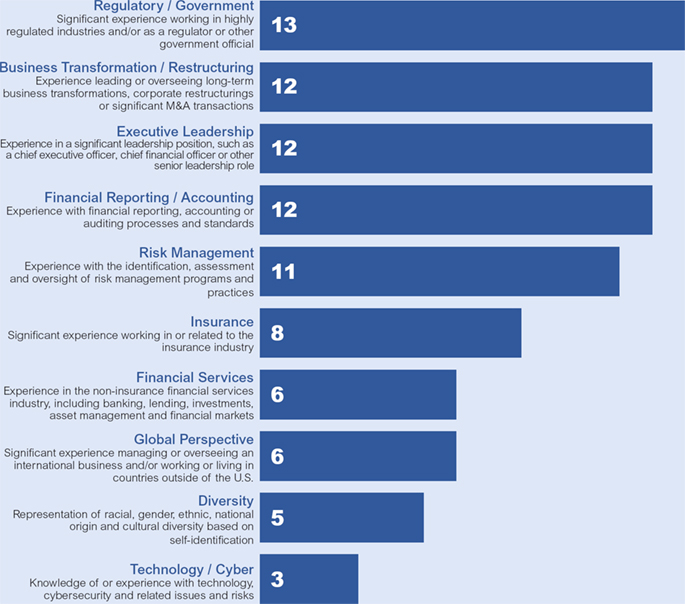

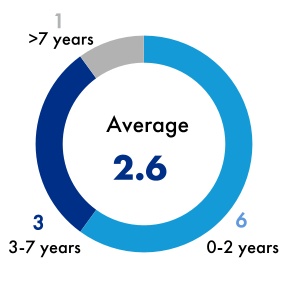

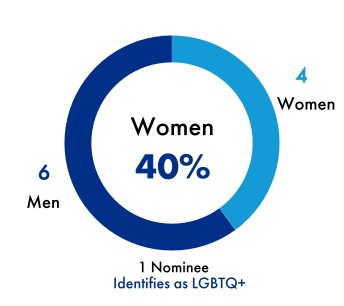

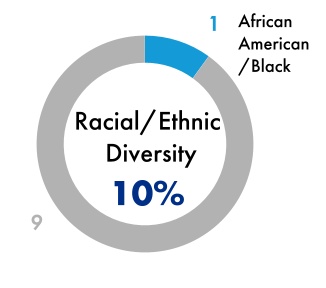

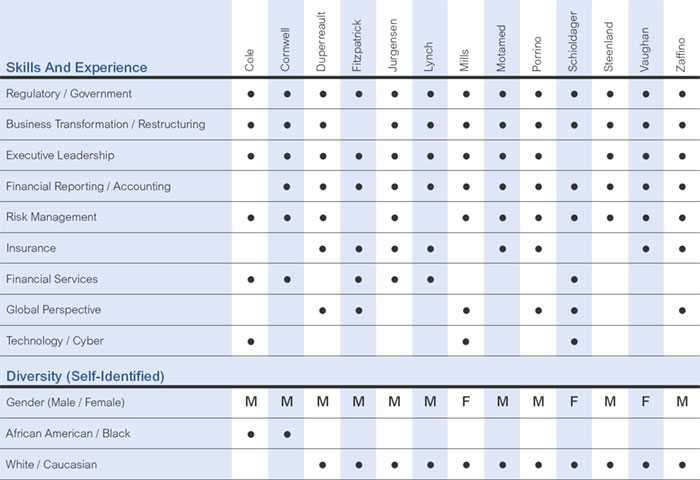

9Executive Summaryand independent Board. AIG hasWe have undertaken significant Board refreshment in recent years to ensure that the directors are positioned to provide strategic guidance to AIGand oversight as we continue to make meaningful progress on strategic priorities, such as the continued separation of Corebridge and the repositioning of our journey to becoming a top performing company.DIRECTOR NOMINEE SKILLS, EXPERIENCE AND ATTRIBUTES

10

2021

Executive Summary

2021 Proxy StatementShareholders Provided Feedback on the Key Topics Below

Executive Summary

ROBUST CORPORATE GOVERNANCE PRACTICES AIG’s robust corporate governance policiespractices promotecultural background — is an important consideration in the director search and nomination process. Additionally, when considering Board effectivenesscomposition and accountabilitydirector refreshment, the Board and NCGC consider diversity in a broad sense, including work experience, skills and perspectives. The total mix of all these considerations contributes to more meaningful Board deliberations and oversight and is critical to our long-term success. Our director nominees include six men and four women, one nominee who is African American/Black, one nominee who is LGBTQ+ and one nominee who is a military veteran. Half of our four standing committees are chaired by a diverse director based on race or gender.Skills, Experience and Expertise Diversity Director Nominee and Title

African

American/

Black

LGBTQ+ 2022 ¢ ¢ ¢ ¢ ¢ ¢ F 2021 ¢ ¢ ¢ ¢ ¢ ¢ ¢ M ¢ 2023 ¢ ¢ M 2024 ¢ ¢ ¢ ¢ ¢ ¢ ¢ M 2015 ¢ ¢ ¢ ¢ ¢ ¢ ¢ F 2023 ¢ ¢ ¢ ¢ ¢ F 2019 ¢ ¢ ¢ ¢ ¢ M 2022 ¢ ¢ ¢ ¢ ¢ ¢ ¢ M 2023 ¢ ¢ ¢ ¢ ¢ ¢ ¢ ¢ F 2020 ¢ ¢ ¢ ¢ ¢ ¢ ¢ ¢ ¢ ¢ M Total Skills, Experience and Expertise and Diversity 7 7 6 7 6 3 7 6 6 4 4 1 6M/4F 1 Independent, DiverseAll of our non-management directors are independent under the New York Stock Exchange (NYSE) listing standards and Qualifiedour independence standards, which are set forth in the Corporate Governance Guidelines available on our website (www.aig.com). To be considered independent, a director must have no disqualifying relationships, as defined by the NYSE, and the Board must affirmatively determine that he or she has no material relationships with the Company, either directly or as a partner, shareholder or officer of another organization that has a relationship with the Company.·All directorsdirector nominees are independent except for ourthe Chairman & Chief Executive Officer and our Executive Chair·All Board Committee members are independent·Lead Independent Director role has clearly defined responsibilities and oversees meeting materials, agendas and schedules·Independent directors meet in executive session in conjunction with each regularly scheduled Board meeting·Three of AIG’s independent director nominees are women and two are ethnically and/or racially diverse·The NCGC continuously reviews the composition of our Board, taking into consideration the skills, experience and attributes of the existing directors, both individually and as a groupEffective Board Policies and Practices·Directors’ interests are aligned with those of our shareholders through robust director stock ownership requirements·The Board, through the NCGC, conducts annual evaluations of the Board, the Lead Independent Director and other individual directors, and all Board Committees conduct annual self-evaluations·No director attending less than 75 percent of meetings for two consecutive years will be re-nominated·Directors generally may not stand for election after reaching age 75·All directors may contribute to the agenda for Board meetings·All directors are prohibited from serving on more than three other public company boards with additional restrictions for AIG’s Chief Executive Officer and directors who are executive officers of other public companies·Board Committee Chair positions generally rotate every five years to ensure diverse perspectivesStrong Shareholder Rights Hold Board Accountable·Directors are elected annually by a majority of votes cast (in uncontested elections)·AIG’s amended and restated by-laws (By-laws) include a proxy access right for shareholders·AIG’s By-laws provide shareholders the ability to call a special meeting at appropriate levels·AIG has an extensive shareholder engagement program with participation by independent directorsKey Matters Overseen by the Board·The Board oversees robust management succession planning, with support from the CMRC, in consultation with the Chair of the NCGC·The Board, through the CMRC, oversees diversity, equity and inclusion matters and monitors AIG’s progress on related initiatives·The Board, through the NCGC, oversees sustainability, including climate-related issues, corporate social responsibility and lobbying and public policy matters·The Board provides strong risk management oversight, including through the Risk and Capital Committee, Audit Committee and other Board Committees·The Board, through the Technology Committee, oversees AIG’s cybersecurity risks, policies, controls and procedures12

2021 Proxy Statement1—1 – Election of DirectorsProposal 1—Election of DirectorsProposal 1—Election of DirectorsWhat am I voting on?We are asking shareholders to elect thirteen directors to hold office until the next annual election.Voting Recommendation✔ FOR the election of each director nominee. The Board believes that, if elected, the nominees will continue to provide effective oversight of AIG’s business and continue to advance our shareholders’ interests by drawing upon their collective qualifications, skills, experience and attributes, as summarized on pages 10-11 and below.AIG's Board currently consists of fourteen directors. All directors serve a one-year term. Mr. Miller is not standing for re-election and is retiring from theDirector Nominees the Annual Meeting because he has reached the age of 75, which is the general retirement age under AIG's Corporate Governance Guidelines. The Board would like to thank Mr. Miller, whose term will end at the Annual Meeting, for his service and valuable contribution as a director. We are asking our shareholders to re-elect the remaining thirteen directors at the Annual Meeting, to hold office until the next annual election and until their successors are duly elected and qualified or their earlier resignation.•Thirteen director nominees•All independent other than Chief Executive Officer and Executive Chair•Elected by majority of votes cast•One year termsIt is the intention of the persons named in the accompanying form of proxy to vote for the election of the nominees. All of the nominees are currently members of AIG’s Board. It is not expected that any of the nominees will become unavailable for election as a director, but if any should become unavailable prior to the Annual Meeting, proxies will be voted for such other persons as the persons named in the accompanying form of proxy may determine in their discretion. Alternatively, the Board may reduce its size.Directors will beMeeting. Each nominee is elected annually by a majority of the votes cast by the shareholders of AIG’s common stock, which votes are cast either “for” or “against” election. Pursuant to AIG’s By-laws and Corporate Governance Guidelines, each nominee has submitted to the Board an irrevocable resignation from the Board that would become effective upon (1) the failure of such nominee to receive the required vote at the shareholder meeting and (2) Board acceptance of such resignation. In the event that a nominee fails to receive the required vote, the NCGC will then make a recommendation to the Board on the action to be taken with respect to the resignation. The Board will accept such resignation unless the NCGC recommends, and the Board determines, that the best interestsin uncontested elections.Paola Bergamaschi

Director since: 2022 and its shareholders would not be served by doing so.Below are biographies of each of the nominees for director, including the principal occupation or affiliation and public company directorships held by each nominee during the past five years. We believe our director nominees have the right mix of skills, experience and attributes and background to provide strategic guidance to AIG, particularly as the Board oversees AIG through its continued transformation to becoming a top performing insurance company. For additional details on the Board’s approach to Board composition and refreshment, see “Corporate Governance—Board Composition and Refreshment.”RECOMMENDATION Your Boardunanimously recommends a vote FOR this resolution.Director Nominees2021 Proxy Statement

13Proposal 1—Election of DirectorsJames Cole, Jr.

Director since: 2021Age: 52Committees:• Audit*• Technology*Other Directorships:• None* Effective March 31, 2021

JAMES COLE, JR.and& Chief Executive Officer, since 2017The Jasco Group, LLC; Former Educationand& General Counsel, of the U.S. Department of EducationCAREER HIGHLIGHTS Mr. Cole founded and has been Chairman and Chief Executive Officer of The Jasco Group, LLC, a multidimensional investment management firm, since January 2017. He previously served at the U.S. Department of Education as Delegated Deputy Secretary of Education and 2016 to 2017from January 2016 to January 2017, General Counsel, a U.S. Senate confirmed seat, from December 2014 to January 2017 and from August 2014 to December 2014. As Deputy Secretary, Mr. Cole served as the chief operating officer of theEducation and oversaw a broad range of operational, management, policy, legal and program functions. From November 2011 to August 2014, Mr. Cole served as Transportationof the U.S. Department of Transportation. Prior2011 to joining the Department of Transportation, Mr. Cole was a corporate law partner at 2014 with a primary focus on Mergers & Acquisitions

Director since: 2021Governance. Mr. Cole began his career as a financial analyst at GE Capital Corporation.KEY EXPERIENCE AND QUALIFICATIONSAIG’sthe Board has concluded that Mr. Cole should be re-elected to the Board. re-elected.James (Jimmy) Dunne III

Director since:2011Age: 73Board Committees:• Compensation 2023Management Resources (Chair)• Nominating and Corporate GovernanceOther Directorships:• Current: Natura &Co Holding S.A.; Viatris Inc.• Former (past 5 years) Pfizer Inc.; Avon Products, Inc.W. DON CORNWELLFormer Chairman of the Board and Chief Executive Officer of Granite Broadcasting CorporationCAREER HIGHLIGHTS Mr. Cornwell is the former Chairman of the Board and Chief Executive Officer of Granite Broadcasting Corporation, which he founded in 1988, serving from 1988 until his retirement in August 2009, and Vice Chairman until December 2009. Mr. Cornwell spent 17 years at Goldman, Sachs & Co. where he served as Chief Operating Officer of the Corporate Finance Department from 1980 to 1988 and Vice President of the Investment Banking Division from 1976 to 1988.KEY EXPERIENCE AND QUALIFICATIONS Cornwell’sDunne’s expertise in investment banking, management and financial sector services and three decades of experience in significant finance and strategic business transformations, as well as his professional experience across the financial services industry, AIG’s Board has concluded that Mr. CornwellDunne should be re-elected to the Board.14

2021 Proxy StatementProposal 1—Election of DirectorsJohn (Chris) Inglis

Director since:2017Age: 73Other Directorships:• Former (past 5 years): Johnson Controls International plc (formerly Tyco International, plc)

BRIAN DUPERREAULTExecutive Chair of AIGMr. Duperreault has beenExecutive ChairU.S. Director of AIG’s Board since March 1, 2021. He previously served as AIG’s Chief Executive Officer since May 2017, when he also joinedNational Intelligence’s Strategic Advisory Group, the National Intelligence University’s Board of Directors. He also served as AIG’s President from May 2017 until January 2020. Previously, Mr. Duperreault was the Chief Executive Officer of Hamilton Insurance Group, Ltd., a Bermuda-based holding company of propertyVisitors

Director since: 2024casualty insurance and reinsurance operations in Bermuda, the U.S. and the U.K., from December 2013 to May 2017, and served as Chairman of Hamilton Insurance Group, Ltd. from February 2016 to May 2017. He served as President and Chief Executive Officer of Marsh & McLennan Companies, Inc. from February 2008 until his retirement in December 2012. Before joining Marsh & McLennan Companies, he served as non-executive Chairman of ACE Limited from 2006 until 2008, as Chairman of the Board from 2004 to 2006, as Chairman and Chief Executive Officer from 1999 to 2004, and as Chairman, President and Chief Executive Officer from 1994 to 1999. Prior to joining ACE, Mr. Duperreault served in various senior executive positions with AIG and its affiliates from 1973 to 1994.KEY EXPERIENCE AND QUALIFICATIONS Duperreault’s deepInglis’s broad and considerable experience in the insurance industry, his history with AIGtechnology, cybersecurity and his management of large, complex, international institutions, AIG’sinformation security, public policy and government, the Board has concluded that Mr. DuperreaultInglis should be re-elected to the Board.elected.Linda A. Mills

Director since:2011Age: 64Board Committees:• Audit• TechnologyOther Directorships:• None

JOHN H. FITZPATRICKFormer Secretary General of The Geneva Association; Former Chief Financial Officer, Head of the Life and Health Reinsurance Business Group and Head of Financial Services of Swiss ReMr. Fitzpatrick has been Chairman of Oak Street Management Co.,an insurance/management consulting company,(management and Oak Family Advisors, LLC, a registered investment advisor, since 2010. He was Chairman of White Oak Global Advisors LLC, an asset management firm lending to small- and medium-sized companies, from SeptemberIT consulting)September 2017. In 2014, Mr. Fitzpatrick completed a two-year term as Secretary General of The Geneva Association. From 2006 to 2010, he was a partner at Pensionpresent and a director of Pension Insurance Corporation Ltd. From 1998 to 2006, Mr. Fitzpatrick was a member of Swiss Re’s Executive Board Committee and served at Swiss Re as Chief Financial Officer, Head of the Life and Health Reinsurance Business Group and Head of Financial Services. From 1996 to 1998, Mr. Fitzpatrick was a partner in insurance private equity firms sponsored by Zurich Financial Services, Credit Suisse and Swiss Re. From 1990 to 1996, Mr. Fitzpatrick served as the Chief Financial Officer and a Director of Kemper Corporation. Mr. Fitzpatrick is a Certified Public Accountant and a Chartered Financial Analyst.KEY EXPERIENCE AND QUALIFICATIONS In light of Mr. Fitzpatrick’s broad experience in the insurance, reinsurance and financial services industries, as well as his professional experience in insurance policy and regulation, AIG’s Board has concluded that Mr. Fitzpatrick should be re-elected to the Board. 2021 Proxy Statement

15Proposal 1—Election of Directors

Director since:2013Age: 69Board Committees:• Risk and Capital (Chair)• Nominating and Corporate GovernanceOther Directorships:• Current: Lamb Weston Holdings, Inc.• Former (past 5 years): Conagra Foods, Inc.WILLIAM G. JURGENSENFormer Chief Executive Officer of Nationwide InsuranceCAREER HIGHLIGHTSMr. Jurgensen is the former Chief Executive Officer of Nationwide Mutual Insurance Company and Nationwide Financial Services, Inc., serving from May 2000 to February 2009. During this time, he also served as director and Chief Executive Officer of several other companies within the Nationwide enterprise. Prior to his time in the insurance industry, he spent 27 years in the commercial banking industry. Before joining Nationwide, Mr. Jurgensen was an Executive Vice President with BankOne Corporation (now a part of JPMorgan Chase & Co.) where he was responsible for corporate banking products, including capital markets, international banking and cash management. He managed the merger integration between First Chicago Corporation and NBD Bancorp, Inc. and later was Chief Executive Officer for First Card, First Chicago’s credit card subsidiary. At First Chicago, he was responsible for retail banking and began his career there as Chief Financial Officer in 1990. Mr. Jurgensen started his banking career at Norwest Corporation (now a part of Wells Fargo & Company) in 1973.KEY EXPERIENCE AND QUALIFICATIONSIn light of Mr. Jurgensen’s deep experience in insurance, financial services and his executive experience managing a large, complex, institution, AIG’s Board has concluded that Mr. Jurgensen should be re-elected to the Board.

Director since:2009Age: 63Board Committees:• Nominating and Corporate Governance (Chair)• Audit• Risk and CapitalOther Directorships:• Current: Tenet Healthcare Corporation• Former (past 5 years): Federal Home Loan Mortgage CorporationCHRISTOPHER S. LYNCHFormer National Partner in Charge of Financial Services of KPMG LLPCAREER HIGHLIGHTSMr. Lynch has been an independent consultant since 2007, providing a variety of services to public and privately held companies, including enterprise strategy, corporate restructuring, risk management, governance, financial accounting and regulatory reporting, and troubled-asset management. Prior to that, Mr. Lynch was the former National Partner in Charge of KPMG LLP’s Financial Services Line of Business. He held a variety of positions with KPMG over his 29-year career, including chairing KPMG’s Americas Financial Services Leadership team and being a member of the Global Financial Services Leadership and the U.S. Industries Leadership teams. Mr. Lynch was an audit signing partner under the Sarbanes-Oxley Act of 2002 and served as lead or client service partner for some of KPMG’s largest financial services clients. He also served as a Partner in KPMG’s National Department of Professional Practice and as a Practice Fellow at the Financial Accounting Standards Board. Mr. Lynch is a member of the Audit Committee Chair Advisory Council of the National Association of Corporate Directors and a former member of the Advisory Board of the Stanford Institute for Economic Policy Research.KEY EXPERIENCE AND QUALIFICATIONS In light of Mr. Lynch’s extensive experience in finance, accounting and strategic business transformations, as well as his professional experience across the financial services industry, AIG’s Board has concluded that Mr. Lynch should be re-elected to the Board. 16

2021 Proxy StatementProposal 1—Election of Directors

Director since:2015Age: 71Board Committees:• Technology (Chair)• Audit• Compensation and Management ResourcesOther Directorships:• Current: Navient CorporationLINDA A. MILLSFormer of Operations, of Northrop Grumman CorporationCAREER HIGHLIGHTSMs. Mills is the former 2013 to 2015of Operations for Northrop Grumman Corporation, with responsibility for operations, including risk management, engineering and information technology. During her 12 years with Northrop Grumman, from 2002 to 2015, Ms. Mills held a number of operational positions, including Corporate Vice& President, and President of Information Systems and Information Technology sectors; sectors, 2008 to 2012Group; and Group, 2006 to 2007in the firm’s Information Technology Sector. PriorSector, 2003 to joining Northrop Grumman, Ms. Mills was2006 at TRW, Inc. She began her career as an engineer at Bell Laboratories, Inc.KEYQUALIFICATIONS

Director since: 2015 in-depth experience with large and complex international operations, risk and financial management, information technology and cybersecurity, and her prior management of a significant line of business, at Northrop Grumman, AIG’sthe Board has concluded that Ms. Mills should be re-electedre-elected.Diana M. Murphy

Board.College of Coastal Georgia Foundation, since 2015

Director since:2019Age: 72Board Committees:• 2023• RiskCapitalOther Directorships:• Current: Kairos Acquisition Corp.• Former (past 5 years)Corporate GovernanceCNA Financial Group; Verisk Analytics, Inc.THOMAS F. MOTAMEDFormer Chairman and Chief Executive Officer of CNA Financial CorporationCAREER HIGHLIGHTSMr. Motamed was Chairman and Chief Executive Officer of CNA Financial Corporation, an insurance holding company, from 2009 to 2016. Prior to CNA, Mr. Motamed spent 31 years at The Chubb Corporation, an insurance company, where he began his career as a claims trainee and rose to Vice Chairman and Chief Operating Officer. He is a past Chairman of the Insurance Information Institute and is Chair Emeritus for Adelphi University.KEY EXPERIENCE AND QUALIFICATIONSMr. Motamed’s deep experienceMs. Murphy’s significant business acumen, including her expertise in insurance,management development and risk management and management of insurance organizations, AIG’sexperience in leading complex companies through strategic and organizational change, her experience as a seasoned public company director, as well as her background in media, communications and marketing, the Board has concluded that Mr. MotamedMs. Murphy should be re-elected to the Board.2021 Proxy Statement

17Proposal 1—Election of DirectorsPeter R. Porrino

Director since: 2019Age: 64Board Committees:• Audit (Chair)• Risk and CapitalOther Directorships:• None

PETER R. PORRINOFormer Executive Vice President and Chief Financial Officer of XL Group LtdMr. Porrino is the former Executive Vice President and Chief Financial Officer of a global insurance(insurance and reinsurance company, a role which he held from 2011 to 2017. He was reinsurance)at XL Group from 2017 to 2018. Prior2018joining XL Group, Mr. Porrino served as the 2017at Ernst & Young LLP from 1999 through 2011 where he was responsible for Ernst Young’s Americas and Global insurance industry practices and served as the lead partner on Ernst & Young’s largest insurance account until his departure. Prior to Ernst & Young, Mr. Porrino served as President and Chief Executive Officer, of Consolidated International1998 to 1999 and as and& Chief Operating Officer of Zurich Re Centre, a subsidiary of Zurich Insurance Group focused on property and casualty reinsurance. Mr. Porrino began his career as an auditor at 1993 to 1998Young.KEYYoung LLPQUALIFICATIONS

Director since: 2019 considerable professional experience related to the global insurance industry, as well as his experience in finance, accounting and risk management, AIG’sthe Board has concluded that Mr. Porrino should be re-elected to the Board.re-elected.John G. Rice

Director since: 2019Age: 58Board Committees:• Audit• since: 2022• TechnologyOther Directorships:• NoneVanessa A. Wittman

AMY L. SCHIOLDAGERFormer Senior Managing Director and Global Head of Beta Strategies at BlackRock, Inc.Ms. Schioldager is the former Senior Managing Director and Global HeadBeta Strategies at BlackRock,Verizon Communications), a global investment management corporation. In this role, which she held from 20062017, Ms. Schioldager was responsible for managing the Index Equity business across seven global offices. During her more than 25 years at BlackRock, Ms. Schioldager held various other leadership positions and also served as a member2016the Global Executive Committee fromGoogle, Inc.)2017 and2014Chair of the Corporate Governance Committee fromPresident & Chief Financial Officer, 2008 to 2015. She also founded and led BlackRock’s Women’s Initiative. Ms. Schioldager began her career as a fund accountant at Wells Fargo Investment Advisors.KEY2012QUALIFICATIONS

Director since: 2023Schioldager’s broadWittman’s experience as a seasoned public company director and senior financial executive in corporate governance,global organizations across a range of industries, including insurance, consumer products and technology, and managing international businesses, as well as her professional experience in investments, global asset management and financial services, AIG’sthe Board has concluded that Ms. SchioldagerWittman should be re-elected to the Board. re-elected.18

2021 Proxy StatementProposal 1—Election of DirectorsPeter Zaffino

Director since: 2009Age: 69Board Committees:• As Lead Independent Director, Mr. Steenland is an ex-officio, non-voting member of all Board CommitteesOther Directorships:• Current:

AirlinesInternational Group, Inc.; Hilton Worldwide Holdings Inc.• Former (past 5 years): Performance Food Group Company; Travelport Worldwide LimitedDOUGLAS M. STEENLANDFormer President and Chief Executive Officer of Northwest Airlines CorporationCAREER HIGHLIGHTSMr. Steenland is the former Chief Executive Officer of Northwest Airlines Corporation, serving from 2004 to 2008, and President, serving from 2001 to 2004. Prior to that, he served in a number of Northwest Airlines executive positions after joining Northwest Airlines in 1991, including Executive Vice President, Chief Corporate Officer and Senior Vice President and General Counsel. Mr. Steenland retired from Northwest Airlines upon its merger with Delta Air Lines, Inc. Prior to joining Northwest Airlines, Mr. Steenland was a senior partner at a Washington, D.C. law firm that is now part of DLA Piper.KEY EXPERIENCE AND QUALIFICATIONSIn light of Mr. Steenland’s notable experience in managing a large, complex institution and his experience in strategic business transformations, AIG’s Board has concluded that Mr. Steenland should be re-elected to the Board.

Director: 2019Age: 64Board Committees:• Compensation and Management Resources• Risk and CapitalOther Directorships:• Current: Verisk Analytics, Inc.; West Bancorporation, Inc.• Former (past 5 years): Validus Holdings, Ltd.THERESE M. VAUGHANFormer Chief Executive Officer of the National Association of Insurance Commissioners; Executive in Residence and Former Visiting Distinguished Professor and Dean of the College of Business and Public Administration at Drake UniversityCAREER HIGHLIGHTSMs. Vaughan is currently an Executive in Residence at Drake University, where she was previously the Robb B. Kelley Visiting Distinguished Professor of Insurance and Actuarial Science from 2017 to 2019 and served as the Dean of the College of Business and Public Administration from 2014 to 2017. From 2009 to 2012, she served as the Chief Executive Officer of the National Association of Insurance Commissioners (NAIC). During her time at NAIC, Ms. Vaughan also served as a member of the Executive Committee of the International Association of Insurance Supervisors and the steering committee for the U.S./E.U. Insurance Dialogue Project. In 2012, she chaired the Joint Forum, a Basel, Switzerland-based group of banking, insurance, and securities supervisors. Additionally, Ms. Vaughan was the first female Insurance Commissioner for the State of Iowa, a role which she held for over ten years.KEY EXPERIENCE AND QUALIFICATIONSIn light of Ms. Vaughan’s considerable experience in the insurance industry as well as her professional experience in insurance regulation, education, research and corporate governance, AIG’s Board has concluded that Ms. Vaughan should be re-elected to the Board. 2021 Proxy Statement

19Proposal 1—Election of Directors

Director since: 2020Age: 54Other Directorships:• NonePETER ZAFFINOPresident and Chief Executive Officer of AIGCAREER HIGHLIGHTSPeter Zaffino has been AIG’s March 1, 2021 and joined AIG’s Board in October 2020. He joined AIG in July 2017 as 2021; President, since 2020President—President & Global Chief Operating Officer, and was also appointed 2017 to 2021in November 2017 and President of AIG in January 2020. Prior to joining AIG, he served in various executive roles at 2019, a global professional services firm, including as Chief Executive Officer of Marsh, LLC from 2011 to 2017 and as (professional services)& McLennan Companies from 2015LLC, 2011 to 2017. Prior to that, Mr. Zaffino served as 2017and& Chief Executive Officer of Guy Carpenter, a risk and insurance-focused subsidiary of Marsh & McLennan Companies. Prior2008 to joining 2011he held several senior positions, most recently serving in an executive role with a 2001 to 2008portfolio company that specialized in alternative risk insurance and reinsurance.KEY1995 to 2001QUALIFICATIONS

Director since: 2020significant experience indeep insurance expertise, leadership capabilities, financial and operational skills, and his continued exceptional performance as the insurance industry, including his leadershipCEO of AIG, the turnaround of AIG’s General Insurance business, AIG’s Board has concluded that Mr. Zaffino should be re-elected to the Board. re-elected.20

2021 Proxy StatementCorporate Governance Corporate GovernanceCorporate Governance AIG Board is committed to good corporate governance. Our strongeffective corporate governance policiespractices that are designed to maintain high standards of oversight, accountability, integrity and ethics while promoting the long-term interests of our shareholders. The Board continuously reviews and considers these practices are set forthto enhance its effectiveness.Amended and RestatedBy-Laws, Certificate of Incorporation, By-laws,Director, Officer and Senior Financial Officer Code of Business Conduct and Ethics, Corporate Governance Guidelines, committee charters, our systematic approach to risk management and Board Committee Charters, among other documents. AIG’sin our commitment to transparent financial reporting and strong internal controls. The Board regularly reviews theseour corporate governance documents and makes modifications from time to time based on corporate governanceto reflect recent developments and shareholderinvestor feedback to ensure their continued effectiveness.What we do:✓The NCGC continuously reviews the composition of the Board to ensure the Board has the substantial and diverse skills, experience and attributes necessary to evaluate and oversee AIG’s strategy and performance✓Directors are elected annually by a majority of votes cast (in uncontested elections)✓All directors are independent except for our Chief Executive Officer and our Executive Chair, and independent directors meet in executive session in conjunction with each regularly scheduled Board meeting✓All Board Committee members are independent✓Lead Independent Director role has clearly defined responsibilities and oversees meeting materials, agendas and schedules✓Directors’ interests are aligned with those of our shareholders through robust stock ownership requirements✓The Board, through the NCGC, conducts annual evaluations of the Board, the Lead Independent Director and other individual directors, and all Board Committees conduct annual self-evaluations✓All directors may contribute to the agenda for Board meetings✓Corporate Governance Guidelines include sound policy on directors’ service on other public company boards✓Board Committee structure organized around key strategic issues and designed to facilitate dialogue and efficiency✓The Board, with support from the Board Committees, oversees key matters, including robust management succession planning; diversity, equity and inclusion; sustainability (including climate-related issues), corporate social responsibility and lobbying and public policy matters; risk management; and cybersecurity✓Extensive shareholder engagement program with participation by independent directors✓By-laws include a proxy access right for shareholders✓By-laws provide shareholders the ability to call a special meeting at appropriate levelsWhat we don’t do:xAny director attending less than 75% of meetings for two consecutive years will not be re-nominatedxDirectors generally may not stand for election after reaching age 75xBoard Committee Chairs generally do not serve for longer than a five-year termxNo supermajority voting requirements in charter or By-lawsxDirectors may not serve on more than three other public company boards with additional restrictions for AIG’s Chief Executive Officer and directors who are executive officers of other public companies2021 Proxy Statement